For New Readers: This newsletter is aimed at capturing day to day value shifts on the S&P futures market. This is done through a process I’ve developed over the past several years by uncovering high probability price levels & scenarios for the next trading session. That’s the scope. The process and training is detailed in the link below. If you’re new here, please read this first:

Here’s this morning’s levels & plan sent out to premium members at 8:10am CST before the bell:

ES Plan:

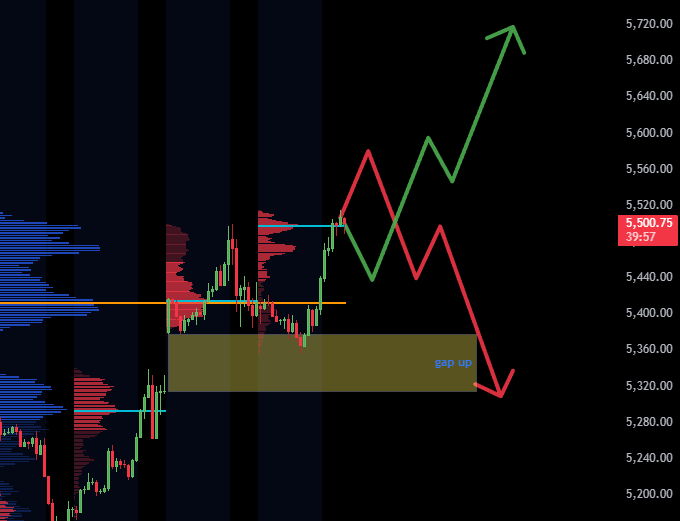

“Even though VIX and ATR levels have dropped a bit, I would still exercise some risk reduction today until you see the weekly cash session volume start. Volatility and speed are still running high and not ideal to optimal intra-day trading conditions. I’ll be watching the overnight low and the weekly POC for my cash session directional cues. Price breaks and holds above the weekly POC, likely price makes an attempt to run to the week’s highs Price fails the weekly POC, likely price makes an attempt to fill that gap up and possibly push back into Tuesday’s value.”

Today’s Levels/Triggers I’m Initially Watching:

Price holds (or quickly recovers) above 5355 look for 5414 to break out (cash session) for that bullish trigger. With sustained bullish flow look for 5456, 5500 and possibly 5530 thereafter.

Price fails 5414, look for a breakdown below 5355 for that bearish trigger. With sustained selling here, look for 5336, 5300 and possibly 5266 thereafter.

Bullish breakout triggered today, 2 targets met. 86 points of fertile ground to look for long entries.

Daily Recap:

Bullish outside day today taking out both sides of yesterday’s near bearish shooter candle, which was also negated today. Instead price dipped into the gap up from Tuesday to Wednesday sometime during the overnight session and price just rallied retracing the wick from yesterday. Broke through the weekly POC (bullish break line) just after the bell and rallied for another 86 points during the cash session to retest 5500.

Today’s Charts:

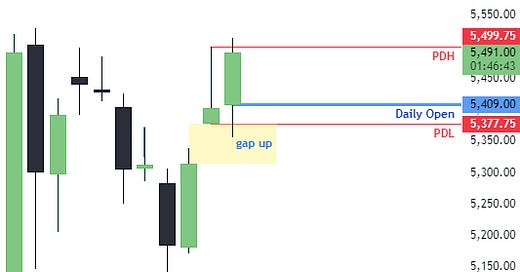

Here’s the daily candle chart showing the outside day. Overnight prices dipped into the gap up and followed by a rally to prior day high.

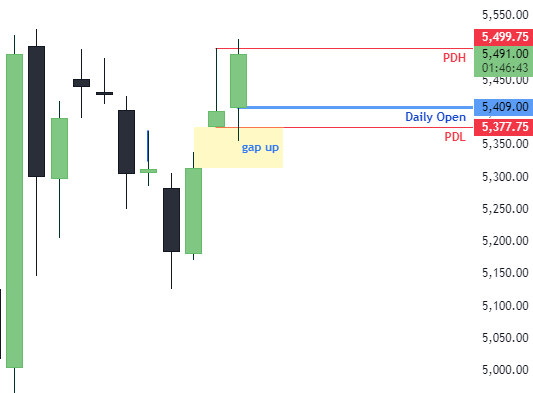

On down to the 30m volume profile. Bear flag breaking out right at the bullish above off the open and price rallied the balance of the day.

Let’s take a look at tomorrow’s setup:

Bullish scenario: Price holds the weekly POC, breaks today’s high and pushes up towards the open POC from 3 weeks ago (5647)

Bearish Scenario: Price fails above today’s high, breaks down below the week’s POC, and makes an attempt to fill the remaining gap up below today’s low.

*Price is not likely to follow either of the above exacts paths, this is just a projection of what I’m looking to see develop*

Upcoming News:

Earnings releases set for this week:

Google earnings up after hours tonight so we’ll see what shakes out in the morning.

I’ll have my Premarket Rundown, available with a premium subscription, before tomorrow’s market open to dial in the specific triggers and targets I’ll be watching along with the overnight pricing assessment, trend and daily bias rundown.

Level to Level Trading Setup Example:

My trading technique revolves around setting high quality, data driven levels and then assessing price action & direction, along with buyers & sellers at those levels once price arrives.

Took some heat on trade two here as I took the initial breakout. The bull flag bottom end held and price rallied to retest 5500. 23 point run with profits taken 1/2 way.

This is level to level trading. For video examples of executions like this head to my YouTube channel at youtube.com/@therealtraderdan.

Levels are derived from a macro analysis along with volume profiling, a technique I’ve developed over the past several years and share within this newsletter. Entries are executed on an analysis of price action and Order Flow footprint charts. To learn both order flow footprint and volume profile trading, again head over to youtube.com/@therealtraderdan and check out both series for free.

None of this constitutes financial advice, these are merely my opinions, strategies and insights that I personally use to trade the S&P 500 and are for educational purposes only. This is not an offer or recommendation to trade futures, stocks, options or forex.

RISK DISCLAIMER: THERE IS A VERY HIGH DEGREE OF RISK INVOLVED IN TRADING. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. ALL INDIVIDUALS AFFILIATED WITH THIS SITE ASSUME NO RESPONSIBILITY FOR YOUR TRADING AND INVESTMENT RESULTS. ALL THE MATERIAL CONTAINED HEREIN IS BELIEVED TO BE CORRECT, HOWEVER, TRADERDAN WILL NOT BE HELD RESPONSIBLE FOR ACCIDENTAL OVERSIGHTS, TYPOS, OR INCORRECT INFORMATION FROM SOURCES THAT GENERATE FUNDAMENTAL AND TECHNICAL INFORMATION. FUTURES AND FUTURES OPTIONS TRADING CARRIES SIGNIFICANT RISK. OPTIONS TRADING CARRIES SIGNIFICANT RISK. FOREIGN EXCHANGE TRADING CARRIES SIGNIFICANT RISK. STOCK TRADING CARRIES SIGNIFICANT RISK. TRADING SECURITIES, SECURITY OPTIONS, FUTURES AND/OR FUTURES OPTIONS IS NOT FOR EVERY INVESTOR, AND ONLY RISK CAPITAL SHOULD BE USED. YOU ARE RESPONSIBLE FOR UNDERSTANDING THE RISK INVOLVED WITH TRADING FUTURES, OPTIONS, STOCKS, AND FOREIGN EXCHANGE PRODUCTS. PRIOR TO TRADING ANY SECURITIES PRODUCTS, PLEASE READ THE CHARACTERISTICS AND RISKS OF STANDARDIZED OPTIONS AND THE RISK DISCLOSURE FOR FUTURES AND OPTIONS

THE INDICATORS, STRATEGIES, SETUPS, METHODS, AND ALL OTHER PRODUCTS AND FEATURES ON THIS WEBSITE ARE FOR EDUCATIONAL PURPOSES ONLY AND SHOULD NOT BE CONSTRUED AS ADVICE. INFORMATION FOR FUTURES TRADING OBSERVATIONS ARE OBTAINED FROM SOURCES BELIEVED TO BE RELIABLE, BUT WE DO NOT WARRANT ITS COMPLETENESS OR ACCURACY, OR WARRANT ANY RESULTS FROM THE USE OF THE INFORMATION. YOUR USE OF THE TRADING OBSERVATIONS IS ENTIRELY AT YOUR OWN RISK AND IT IS YOUR SOLE RESPONSIBILITY TO EVALUATE THE ACCURACY, COMPLETENESS, AND USEFULNESS OF THE INFORMATION.

YOU MUST ASSESS THE RISK OF ANY TRADE WITH YOUR BROKER AND MAKE YOUR OWN INDEPENDENT DECISIONS REGARDING ANY SECURITIES MENTIONED HEREIN. ANY PERSON WHO CHOOSES TO USE THIS INFORMATION AS A BASIS FOR THEIR TRADING ASSUMES ALL THE LIABILITY AND RISK FOR THEMSELVES

CORRECTION, all three targets all 3 hit today. I had to duck out early and price ran to T3 during power hour